If you think now is a good time to buy a home, you probably need a mortgage. Mortgages can come from banks, credit unions or other financial institutions, but any lender will want to make sure you meet some basic qualifying criteria before giving you money to buy a home.

How to find out how much house I qualify for

There are variations in the specific requirements from lender to lender, and also variations depending on the type of mortgage you get. However, you will usually have to meet certain criteria for any mortgage lender before you can get approved for a loan.

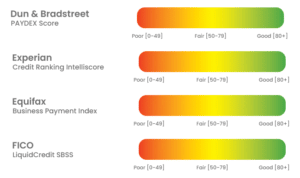

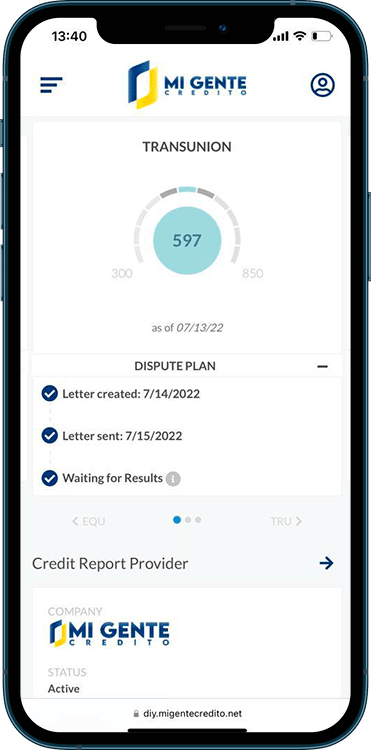

Your credit score is determined based on your past payment history and your borrowing habits. A credit check is the first thing most lenders do when you apply for a mortgage. The higher your score, the more likely you are to get a mortgage and the higher the interest rate.

For a conventional mortgage, you’ll generally need a credit score of at least 620, although you’ll pay a higher interest rate if your score is below 700.

Buying a home with a low credit score means you’ll pay more for your mortgage for as long as you have the loan. Try to raise your score as much as you can.

Your debt-to-income ratio

Your debt-to-income ratio (DTI) is the amount of debt you have in relation to income, including your mortgage payments.

Unlike credit scores, the guidelines for DTI are fairly similar regardless of the type of mortgage. To qualify for a conventional mortgage, your debt-to-income ratio is generally capped at around 43%, although there are some exceptions.

Smaller lenders may be more flexible in allowing you to borrow a little more, while other lenders have stricter rules and cap your DTI ratio at 36%.

For a VA loan, the preferred maximum debt-to-income ratio is 41%, while FHA generally allows you to go up to 50%. However, it is sometimes possible to qualify even with a higher DTI. For example, the VA will still lend to you, but when your ratio exceeds 41%, you will need to provide more proof of your ability to repay.

If you owe too much, you will have to buy a cheaper home with a smaller mortgage or work to pay off your debt before trying to borrow for a home.

Your down payment

Lenders usually want you to put money down on a home so that you have some equity in the home. This protects the lender because the lender wants to recoup all of the funds they have loaned you if you default.

If you borrow 100% of the value of the home and don’t repay the loan, the lender may not get their money back in full because of fees for selling the home and the possibility of home prices going down.

Ideally, you will put down 20% of the cost of your home when you buy a home and borrow 80%. However, many people put down much less. Most conventional lenders require a minimum down payment of 5%, but some allow you to put as little as 3% down if you are a highly qualified borrower.

FHA loans are available with a down payment as low as 3.5% if your credit score is at least 580. And VA loans require no down payment unless the property is worth less than the price you are paying for it.

If you put less than 20% down on a home with a conventional mortgage, you will have to pay private mortgage insurance (PMI). This typically costs about 0.5% to 1% of the amount borrowed each year. You would have to pay PMI until you owe less than 80% of the value of the home.

Your employment history

All lenders, whether for a conventional mortgage, VA loan or FHA loan, require you to provide proof of employment.

Generally, lenders want to see that you have worked for at least two years and have steady income from an employer. If you do not have an employer, you will need to provide proof of income from another source, such as disability benefits.

The value and condition of the home

Finally, lenders want to make sure that the home you are buying is in good condition and worth what you are paying for it. A home inspection and home appraisal are usually required to make sure the lender is not giving you money to get into a bad real estate deal.

If the home inspection reveals major problems, they may need to be fixed before the loan can close. And the appraised value of the home determines how much the lender will allow you to borrow.

If you want to pay $150,000 for a home that is appraised at only $100,000, the lender will not lend you based on the full amount. They will lend you a percentage of the $100,000 appraised value, and you will have to pay not only the down payment, but also the additional $50,000 you agreed to pay.

If a house appraises for less than you have offered for it, you will usually want to negotiate the price down or walk away from the transaction, since there is no reason to overpay for real estate. Your purchase agreement should have a clause specifying that you can walk away from the transaction without penalty if you cannot secure financing.

Shop around among different lenders

While all mortgage lenders consider these factors, different lenders have different rules about exactly who can qualify for financing.

Be sure to explore all your options for different types of loans and shop around among mortgage lenders so you can find a loan you can qualify for at the best possible rate given your financial situation.