Your credit score can have a big impact on your financial life. It plays a key role in a lender’s decision to grant you a loan. For example, someone with a credit score below 640 is often considered a high-risk borrower.

Lenders often charge higher interest rates on subprime loans than on traditional mortgages to compensate them for the higher risk they take on. They may also require shorter repayment terms or provide guarantees for borrowers with lower credit scores.

In contrast, a credit score of 700 or higher is generally considered good and may result in the borrower receiving a lower interest rate and therefore paying less interest over the life of the loan. Scores that are above 800 are considered excellent. Although each creditor establishes its own range of credit scores, the average range of FICO scores is generally used.

Excellent: 800-850.

Very good: 740-799.

Good: 670-739.

Acceptable: 580-669.

Difference: 300-579.

A person’s credit score can also determine the down payment needed to get a smart phone, cable TV service or utilities, or rent an apartment. Lenders often review a borrower’s score, especially when deciding whether to change a credit card’s interest rate or credit limit.

Credit Scoring Factors: How to Calculate Your Score

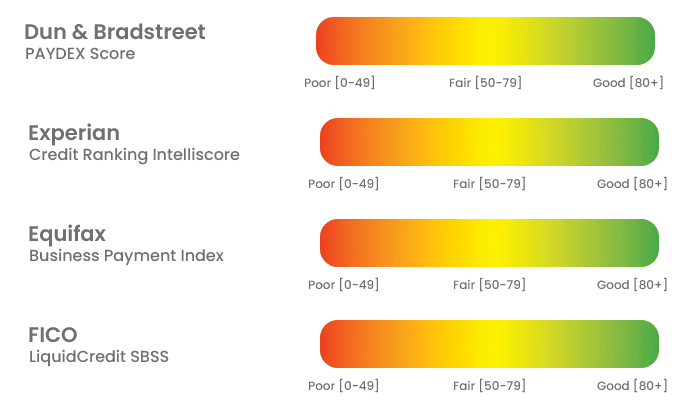

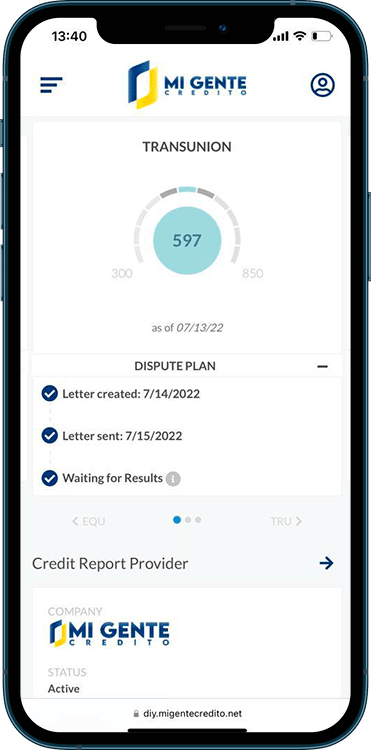

The three major U.S. credit rating agencies (Equifax, Experian and TransUnion) report, update and store consumer credit information. Although the information collected by the three credit bureaus may differ, five main factors are evaluated when calculating your credit score:

Payment history.

Total amount paid.

Length of credit history.

Type of credit.

New loan.

Payment history represents 35% of a credit score, which shows whether a person makes payments on time. The total amount owed is 30% and takes into account the percentage of credit available to the individual, known as the credit utilization ratio. Length of credit history accounts for 15%, a longer credit history is considered less risky because there is more data to build a payment history.

The type of credit used accounts for 10 percent of the credit score and shows whether a person uses down payment credit (such as a car loan or home loan) and revolving credit (such as a credit card). New credit is also 10 percent and takes into account how many new accounts the person has, how many new accounts he or she has recently applied for, has activated a credit application and when the last account was opened. What is a good credit score? Ranges vary by credit scoring model, but generally a credit score between 580 and 669 is considered fair; 670 to 739 is considered good; 740 to 799 is considered very good; and 800 is considered excellent.

Your credit score is a number that can cost or save you a lot of money over your lifetime. A good score can earn you a lower interest rate, which means you’ll pay less for any line of credit you apply for. However, it’s your responsibility as a borrower to make sure your credit is strong so you can get additional loan options if necessary.