Your credit score, or also known as a credit rating, is one of the most important parts of building a solid financial foundation. Learning about the factors that affect your credit score can help you take steps to get an excellent credit score to help with things like:

Obtain low-interest home and auto loans.

Getting the best insurance rates.

Qualify for a rental property.

Get the job of your dreams.

What is a credit score?

A credit score or credit rating is a three-digit number generated by a mathematical algorithm. There are a variety of these complex formulas, but they all take into consideration things like credit history, amount owed, payments made, new credit and types of credit used.

Your credit score is crucial to obtaining financing, whether you want to open a credit card, get a car loan or mortgage a home. Your credit score helps determine whether you get the loan in the first place and at what interest rate you will be charged for borrowing the money.

It also shows your reliability and determines whether you’ll be able to rent an apartment, borrow a car, get a good insurance rate or get the job you want.

Ultimately, this magic number gives providers a quick and fair way to assess risk.

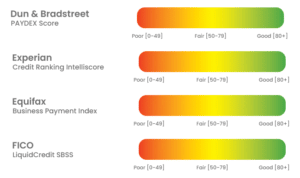

What are the different types of credit scores?

Each credit bureau and agency has its own rating formulas. The higher the number, the higher the credit rating.

Experian: 330 – 830.

Equifax: 300 – 850.

TransUnion: 300 – 850.

FICO: 300 – 850.

VantageScore: 501 – 990 (often assigned a letter grade, A – F).

What constitutes a credit score or credit rating?

A credit score is calculated using factors that include:

Payment history.

Amounts owed.

Credit history.

New accounts.

Types of credit.

How is a credit score calculated?

While different bureaus and scoring agencies have different formulas for determining your score, we review the FICO score guidelines, as they are the biggest influence for most lenders.

Payment History: The most important factor in calculating your score is your payment history. Paying on time weighs 35% of your score.

Amount owed: Another important factor used to calculate your credit score is what you owe. It is a whopping 30% of your overall score. If you borrow too much money that you have borrowed, it looks like you don’t have enough money to keep up with life’s expenses. Also, because your balance is reported to the bureaus separately from the payments you make, avoid accumulating large balances. Credit history: Another consideration used to calculate your score is your credit history and whether you are opening new lines of credit. This credit history accounts for 15% of your score. To feel comfortable lending money, banks would like to see a long and consistent history of credit usage. That is, that you are a financially responsible person.

New credit: While the age of your accounts affects your score for the better, you also don’t want to have too many accounts open in a short period of time. Not only will this lower the average age of your credit accounts, but it can also put up a red flag that you’re desperate for more credit. New credit makes up 10% of your credit score.

Tip: If you’ve applied for a credit card and been denied, it’s best to wait a while. Try to improve your credit by making consistent payments at lower balances. Then, you can try to reapply as long as you allow some time to pass after the denial.

What hurts my credit rating?

While it’s important to know what can help your credit, knowing what can hurt your credit score is just as important. Knowing what can lower your credit score allows you to take control of your financial future.

Paying late or not at all

Even being late on a payment will seriously affect your score. And not paying at all is even worse.

Having your account charged off

When a lender believes that you don’t intend to make payments on your account, such as in the case of missing a payment, they may “charge off” your account.

Defaulting on your loan

This means that you have somehow failed to comply with the terms of your loan, such as making a payment.

Filing for bankruptcy

This is a serious action on your part to declare that you are unable to make loan payments.

Court Judgments

If you have been unable to repay your loans, a lender may take you to court to get paid. All judgments are disadvantageous to your score.

High or borderline balances

The most damaging thing you can do is to have a high or over-the-limit balance, as this is the most important factor in your credit score.

Too many credit card applications

Avoid applying for new credit cards too often.

Having only one type of credit

Credit cards are considered one type of credit, known as revolving credit. If you only have one type of loan on your credit report, it is not as favorable.

How do I improve my credit rating?

Avoid late or delinquent payments…

Work to pay off debt.

Avoid applying for additional credit.

Keep debt as low as possible.

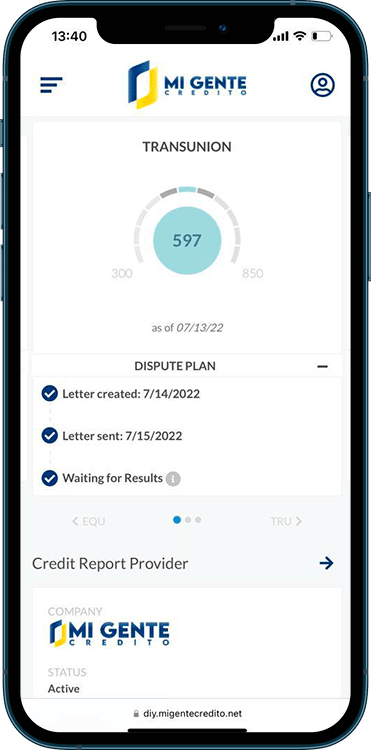

Why should I monitor my credit score?

Surely, you now know how important your credit score is. Regular monitoring is imperative to improving and maintaining your score. We know life is busy, but here’s why you need to monitor your credit score.

You were denied credit.

You signed for a loan.

To be on the lookout for identity theft.

You plan to apply for a loan in the future.