Taking the leap into homeownership is always a big decision, whether you’ve been saving for years or want to take advantage of a first-time homebuyer program. The process is complicated and can be overwhelming if you are not prepared.

Let’s take a look at some tips for first-time homebuyers and the most common pitfalls you’ll want to avoid so you’re well-informed before you buy.

Key points

Start preparing your finances well in advance before applying for a mortgage.

Compare multiple offers from lenders to find the best deal.

Take advantage of first-time homebuyer programs for low interest rates and down payment assistance.

A real estate agent can be an invaluable ally to walk you through the various steps of the home buying process.

Prepare your finances

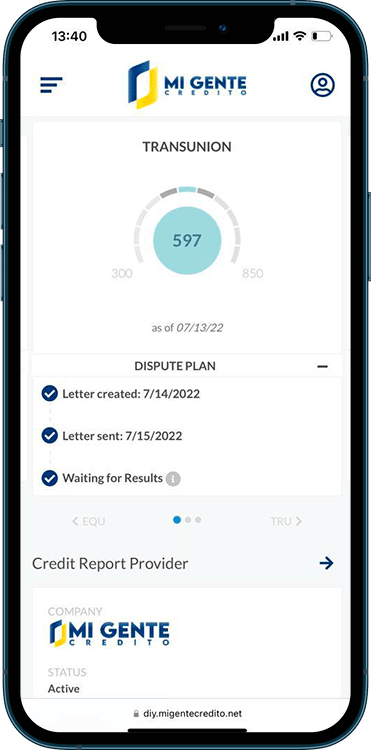

One of the most important tips for buying a home is that you should prepare your finances. Your new home is an investment, but a mortgage loan is also an investment for your bank. Your bank is looking for low-risk customers for loans, so you’ll need to demonstrate financial stability.

There are a few things you can do to prepare your finances before acquiring a mortgage, according to John Cabell, director of banking and payment intelligence at J.D. Power and Associates. Pay off your debts, make your payments on time and avoid opening new loans or credit cards. Cabell told The Balance via email that a common mistake is to acquire new debt, even if it is well in advance of applying for a mortgage loan.

New accounts don’t show up instantly on your credit report. They usually take at least a few weeks to show up. You’ll also want to start saving for a down payment at this time, although the amount you’ll need may be determined by the mortgage you’re applying for.

Determine your budget in advance

Your budget will depend on several factors, such as the size of your down payment and the mortgage programs you’ll be using. Generally, banks will want you to maintain a debt-to-income ratio of less than 36% to make sure you’ll be able to repay the loan.

Mortgage calculators can help you determine your monthly payment. It’s also important to calculate how much house you can afford based on your income. Don’t forget to calculate the “invisible” costs of homeownership when determining your budget. These include maintenance costs and property taxes.

Beware of going over budget. This tendency to go over budget has increased over the years. About 28% of buyers spent more on their home in 2021 than their initial budget allowed.

Don’t buy based solely on the market

The housing market always fluctuates. Sometimes there will be more homes for sale than there are interested buyers. This results in a buyer’s market. Properties sell out quickly, and multiple offer situations may be more common at other times.

Market timing is the act of trying to predict the best time to buy and waiting until then. This might mean you will save some money or face less competition, but trying to time the market is something you should avoid.

Waiting for the market to change can have more than one downside, such as spending more money on rent or risking further home price increases.

Explore your mortgage options

There are many types of mortgage loans, including specialized loans for first-time homebuyers. These loans often have lower interest rates or reduced down payment requirements. Make sure you’ve thoroughly researched all your options before jumping into one type of mortgage.

Research first-time homebuyer assistance

Look into first-time homebuyer programs. These programs can provide down payment assistance or vouchers for buying a home. They can save you tens of thousands of dollars. Many programs consider first-time homebuyers to be those who have not lived in or owned their own home in the last three years.

Compare multiple loan offers

Each bank charges its own set of fees, which can result in fairly significant differences in costs. You’ll also find different annual percentage rates (APRs) at different banks, so getting more than one offer is critical to finding the lender that’s right for you.

Don’t forget to get a pre-approval letter from your bank once you’re ready to start shopping for a home. Many sellers require that you have it before they will accept an offer on a home.

The number one mistake first-time homebuyers make is not preparing before going to buy a home. It is crucial in any market to make sure you have a pre-approval letter with a local lender just in case you find the perfect home during your first home viewing.

Make a list of “must have” home features.

It can be easy to start adding things to your list of needs and wants when you start touring homes. But you’ll want to make sure the list is true to what you really want. Is location important to you? What about schools? Does the home need to be turnkey, or are you willing to do a renovation project?

Remember that there are many things you can change in a home, such as the kitchen, backyard, bathrooms and bedrooms. What you can’t change is the location or the size of the lot. Keep this in mind when determining your “must-haves”.

Hire an agent

A real estate agent is an expert at their job, which is to find the home that best suits your needs. They will be able to tell you if a house is priced right, if the neighborhood is good, and how quickly properties sell. They will also be able to negotiate on your behalf and prepare the necessary paperwork for you.

It is possible to do all of this yourself, but an agent is almost always the best option for a first-time homebuyer.

Don’t skip the inspection

The home inspection is meant to uncover problems in the structure, plumbing, roof and other parts of the house that could be very expensive to repair. You may have a good eye, but a professional will be better equipped to examine the property. You will have to pay for it, but the inspector will send you a comprehensive report detailing the condition of the property upon completion of the inspection.

Plan your offer carefully

The offer you make will depend largely on what the market is like. You’ll have more room to negotiate if there’s less competition, but you’ll have to be prepared for other offers if it’s a seller’s market.

According to Leo Esguerra, an agent in San Diego, California, listening to your agent’s recommendations is key when preparing an offer. There are a lot of moving parts in real estate, and an agent’s guidance can make the difference between failure and success.

This is especially true in hot markets, which often occur when interest rates are low. You will need to be flexible and creative to get your offer accepted. Consider writing a personal letter to the seller, stretching your budget for your dream home or leaving out contingencies.

Negotiate thoroughly

Knowing how to negotiate is critical, and this is another situation where a real estate agent can be invaluable. You may have to negotiate if the seller does not accept your initial offer. You may also have to do so if the home inspection reveals problems.

It is often possible to work with the seller to have them repaired before you buy the property. You can also ask for a credit against the sales price so you can fix the problems yourself.

Be prepared and willing to negotiate with the seller to get the best deal, and don’t be afraid to walk away if you can’t come to an agreement. There is always another house.