Few buyers can afford to pay cash for the full price of new or used car purchases. Instead, you will need to obtain an auto loan to cover the entire cost of the vehicle or a substantial portion of it.

When you know how much you can borrow, what interest rate you qualify to receive and how long lenders are willing to extend a loan, you’ll have a better idea of how much car you can afford.

Getting the right auto loan can save you money, while getting the wrong loan can cost you in a number of ways, including damaging your credit.

A car loan payment is only part of the cost of owning a new or used vehicle; there’s also fuel, maintenance, insurance and parking. Your monthly payment should fit your budget while paying off the balance as quickly as possible.

Smart car shoppers know precisely how much vehicle they can afford and have a plan to finance their new ride before they even think about going to a dealership. You may end up with the financing agreed to by the dealership, but if they don’t have an offer to beat, they will have no incentive to offer you a more affordable deal.

Learn the language of lending

Auto loan or auto financing an auto loan is a contract between you and a lender in which they agree to provide you with the cash to buy a new or used car, and you agree to pay the money back over time.

Interest (also Finance Charge): Interest is the cost of borrowing the money from the lender. It is expressed as an interest rate (often called an annual percentage rate or APR). Interest covers the lender’s costs and risks and provides the lender with a profit margin.

Auto Loan Term: The loan term is the length of the auto loan and is usually expressed as a number of months. Loan terms of 36 to 48 months were the most common lengths.

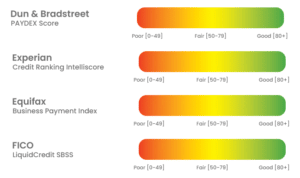

Credit score: A credit score is a three-digit number that represents a credit reporting agency’s analysis of your credit history. The higher the score, the better.

Know what your credit score is and why it’s important

Your credit score is a snapshot of your creditworthiness and your ability to repay an auto loan (or any other type of loan or credit card). It’s essentially the information on your credit report reduced to a three-digit score.

Lower numbers show a higher likelihood that a borrower will default on their loan.

In reality, you have multiple credit scores, as different credit reporting companies use different methods to determine scores.

If you have a high credit score, you are more likely to get an auto loan with a low interest rate than if you have a lower score. Consumers with lower scores will generally have a more difficult time obtaining a loan and can expect to pay a higher interest rate for their loan. If you have steady employment and a score of 720 or higher on most scales, you should have no problem obtaining financing.

What else are lenders looking at?

There are several things on your credit report that are not reflected in your credit score. Your age, income, marital status, address or employment are not included in your score, although your lender may request that information on your loan application and use it to the extent legally permitted.

Beyond the information on your credit report, the lender will be evaluating your ability to repay your loan: Do you have cash flow to make your monthly payments? What is your monthly rent? They will want to know about your income, your sources and how stable your employment is.

Find a good financing deal

Different lenders charge car loan interest rates based on market demand, your creditworthiness, how much you’re borrowing versus the value of the vehicle (the loan-to-value ratio) and your appetite for risk. Rates in the marketplace can vary substantially, depending on the lender. With a little research, it’s easy to find competitive rates and promotional offers with generous terms.

Where can you get an auto loan?

Just as you must shop for a vehicle at multiple dealerships, you must shop with multiple lenders to find the best deal when you’re financing a car. Never before have car buyers had the multitude of loan options and easily accessible rate information that they have today.

Community Banks

Community banks tend to have anywhere from one physical branch to a few dozen, spread out over smaller geographic areas. They may not have all the branches and services of national banks, but you may find it easier to talk to a local representative if you need a little help getting a loan.

Captive finance companies

Most automakers have finance arms, known as captive finance companies. While they provide traditional auto loans, they are also responsible for financing the automaker’s special financing arrangements. Typically, you won’t find any other lender offering 0% interest or other rates that are well below the market average.

Credit Unions

Credit unions differ from other lenders. They are member-owned cooperatives. Instead of providing profits to shareholders, not-for-profit credit unions return excess income to members.

Finance Companies

Finance companies provide financing for various consumer purchases, including automobiles. While they lend money like other financial institutions, most do not accept deposits. In many cases, finance companies offer specialized services to specific types of customers, such as those with subprime credit or those purchasing vehicles from their franchised new car dealership affiliates.

Choose the shortest term you can afford

In general, you want to get the shortest auto loan you can afford for your next car. While a longer term loan may have a lower payment, it is also likely to have higher loan rates and a higher overall cost. Choosing a shorter loan will likely have a rate discount compared to longer terms.

Apply for an auto loan the right way

You should apply for an auto loan from several lenders and shop around for the offer that gives you the best deal. It may take a little time and you will have to provide your personal information to several lending institutions.

There is nothing wrong with submitting multiple applications, as long as you do it in a short period of time to avoid hurting your credit score. If you space out your applications over months, each application will lower your credit score a few points. Make them over a short period of time and the credit reporting agencies will view multiple inquiries as one inquiry.

It is critical that you have an offer before you visit the dealer, although you may not need to use it. You’ll want to do this a week before you visit the dealer so you can have a pre-approved agreement in your pocket before you actively start shopping for a car.

If you do it right, any inquiries they make with the credit bureaus will not affect your credit score. If you don’t have a pre-approved financing package, the dealership will have nothing to try to beat and you will be forced to settle for whatever auto financing deal they offer you.

With pre-approval, you can avoid the pressure of accepting a deal that is bad for your wallet.

Look carefully at dealer financing offers.

Once you’ve researched what used or new car financing is available, and have a pre-approved deal in hand, it’s time to move on to the fun part: buying a car.

Knowing that you already have a financing plan you can afford can help take a lot of stress out of the process and allow you to focus on negotiating a great price for your new ride and a fair deal on your trade-in.

Finalize the deal

Once you have negotiated a deal that is acceptable to both you and the seller, it’s time to sign the paperwork. It’s imperative that you read through all the documents to make sure they match the terms you agreed to and that they don’t include costly add-ons or spaces left blank.

If there are errors or blanks, insist that they be corrected or completed before signing the papers. If the finance officer says to go ahead and sign and then he or she will correct it, you should politely decline and say that you will only sign when it is correct.