Many times situations arise in which the income is not enough to cover the payments, either by layoff or by the drop in production of your company or industry, by a decrease in working hours or by any other means, you suffer from decapitalization.

The first concern is not being able to cover the expenses of the credit for the acquisition or the mortgage of your house. That is why there are means that help in one way or another to solve this situation that seems hopeless, such as refinancing your home.

What is mortgage refinancing?

When you refinance your mortgage, the new loan replaces your current loan. Depending on the type of refinancing, your new loan may have a different term, interest rate or principal balance.

You do not need to refinance with your current lender. If you choose another lender, you will pay off your existing loan and terminate your relationship with the previous lender.

You can choose between two main types of refinancing: a term refinance or a cash-out refinance.

Refinance Terms and Rates

With term and interest charges, you change your interest rate or the length of time you have to repay the loan. You can reduce your monthly payments by extending the term of your loan, or save on interest by increasing your monthly payments. You may also qualify for a lower interest rate. Refinancing the loan term or interest rate does not change either the principal amount or the original loan amount.

Payoff Refinance

A cash-out refinance occurs when you reach equity. Equity is the amount you pay for a home through a down payment or monthly payments. A cash-out refinance allows you to take money out of your equity for a variety of purposes, whether you need to pay your credit card bills, make home improvements, build your retirement savings or create a college fund for your child.

When refinancing with cash out, the interest rate and term cannot change. A cash-out refinance increases the principal balance of your mortgage. In exchange for cash out, you agree to take out a more expensive loan. For example, let’s say your loan balance is $75,000, but you need $10,000 to upgrade your kitchen.

A cash-out refinance means you agree to borrow $85K and your lender will give you $10K in cash. You must have a certain amount of equity in your home to qualify for a cash-out refinance.

Remember that not everyone is eligible for refinancing. To obtain it, you must meet the lender’s individual conditions. Before you begin shopping for a lender, consider the following:

Current home value: if you have already paid off your $10K mortgage, don’t assume you can refinance the $10K with cash. Lenders require that the equity in your home exceed the assets you want to retire. The amount of equity required to qualify for a refinance varies by lender and loan program.

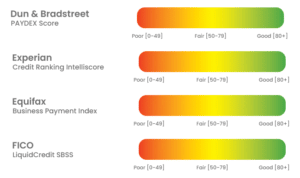

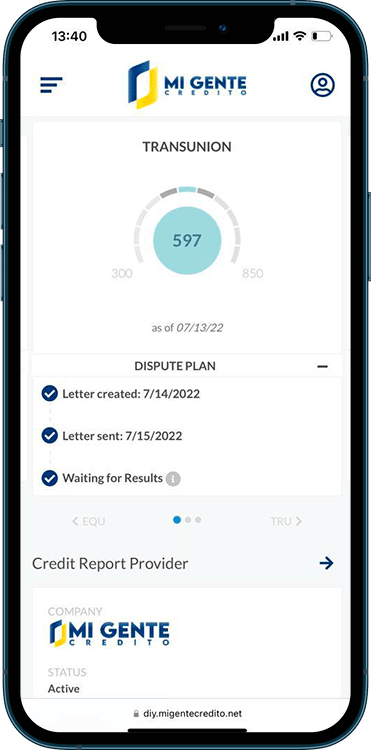

Credit Score: Lenders review your credit score when reviewing your refinance application, just as they do when you apply for a mortgage. To qualify for a refinance, you must have a credit score of at least 620 (580 if you have an FHA loan).

Other debt: Your mortgage lender will also review your current debt-to-income ratio when considering refinancing. The lower your debt is when you apply, the better your chances of being approved. Reasons to refinance a mortgage

There are many reasons you might want to refinance your mortgage. Let’s look at a few:

Edit your monthly payment.

You can lower your monthly payments by refinancing the loan with a longer term. For example, if you refinance a 10-year mortgage with a 20-year loan, you have more time to pay off what you owe. This means your monthly premiums will be lower.

If you are having difficulty making your monthly payments, extending the term can help normalize the situation. Remember, if you extend the term, you pay more interest over time.

You can also reverse the procedure and shorten the term. By shortening the term through refinancing, you save on interest and can pay off your mortgage loan in less time.

However, you will also increase the amount you have to pay each month because you don’t have as much time to pay off the loan. A short-term refinance is a good option if your income is higher than when you took out the mortgage.

Lower interest rates

If you have a higher credit score or less debt than when you first got your mortgage, you may qualify for a lower interest rate. You may also qualify for a lower rate if market rates drop after the loan is signed.

How does refinancing work?

Now that you understand the potential benefits of refinancing loans, let’s look at how the process works in practice. Find a lender to help you refinance.

First, you need to choose a lender. Refinancing a loan is a serious decision, so make sure you choose a reliable and affordable loan. Don’t be afraid to compare each lender’s current interest rates, availability and customer satisfaction ratings.

Prepare the necessary documents

Your lender will need some documents to process your application. Preparing the documents ahead of time can speed up the process. Some documents your lender may request are:

Your last two paychecks.

Your last two W-2 forms.

Your last two bank statements.

If you are married, your lender should also use your spouse’s documents. If you are self-employed, you may be asked for additional income documents.

Applying through your lender

Once your documents are ready, you can apply for refinancing through your lender. The exact process you must go through depends on your particular lender.

Regardless of the lender you choose, you will receive a document called a “loan appraisal” once approved, your loan estimate will include the new loan terms, your APR and an estimate of how much you will pay at closing. Your lender may allow you to “freeze” your rate while you go through the underwriting and settlement process.

Underwriting

The underwriting stage is when your lender reviews all of your documents to make sure you qualify for refinancing. At this stage, your lender reviews and verifies the documents you have submitted with your application.

Your lender provides the collateral for you; you just have to wait Most refinance guarantees take 1 to 2 weeks, but any third parties involved in the process, such as appraisers, can delay this step.

Appraisal

Just like buying a home, an appraisal is required before refinancing. Your lender requests an appraisal, an appraiser visits your property and you receive an appraised value of the home; if the value of the home equals or exceeds the amount you wish to refinance, the appraisal is complete.

Your lender will contact you with closing information. What if the appraised result is lower? You may choose to reduce the amount you wish to receive through refinancing, or you may cancel your application.

Closing

Completing a refinance is very similar to taking out an original mortgage. Since you already own the property, you don’t need to worry about a seller or real estate agent. At closing, you can ask any last-minute questions about your loan, pay the closing costs (or roll them into the loan if you have enough equity) and sign a new loan.

With a cash-out refinance, you will not receive cash at closing. The Truth in Lending Act requires your lender to pay off your refinance within 3 business days of closing. The lender will then transfer the money to your account.